In the ever-evolving landscape of direct-to-consumer (DTC) marketing, success hinges on the delicate balance between revenue and profitability. Many marketers, in their pursuit of quick wins, often overlook the crucial detour needed to understand the distinction between the two. This blog post, brought to you by DTC Marketing Group, aims to explore this detour and shed light on why misinterpreting the relationship between revenue and profitability can lead to inefficient allocation of marketing dollars.

Detour Exploration – Revenue vs. Profitability:

In our journey to step 2, we’re taking a detour (Step 1a) to dissect the difference between revenue and profitability. One of the critical elements we’ll explore is the impact of customer retention and churn on closing the gap between revenue and profitability.

Real-Life Customer Acquisition Marketing Scenario:

Let’s delve into a real-life scenario recently shared with us. Imagine being a customer acquisition marketer tasked with driving growth for a subscription-based business. Armed with historical data for customer unit economics, the marketer faces a crucial decision: whether to rely on the past or take a different path. The chosen route involves building a customer lifetime value (LTV) model based on assumptions from a previous business, resulting in a misaligned customer acquisition cost (CAC).

Analysis of the CAC:LTV Marketing Scenario:

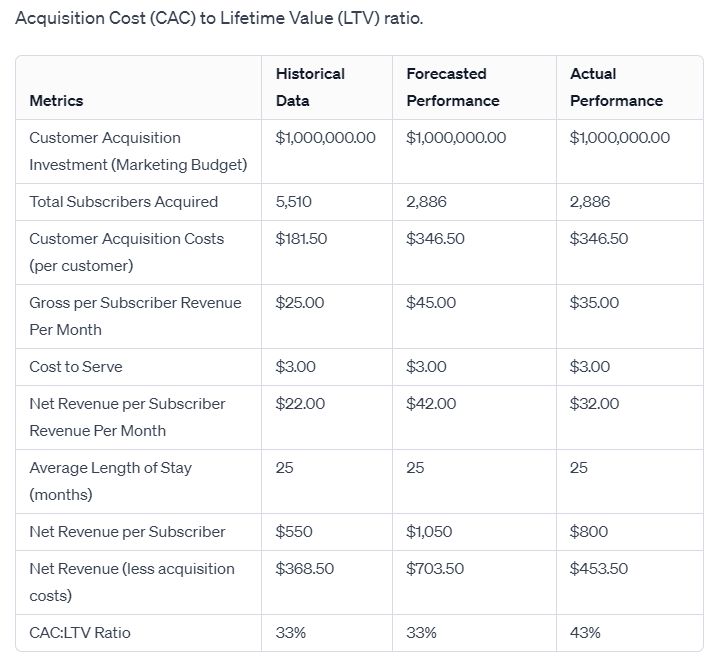

The attached photo provides a visual representation of the scenario’s analysis. The marketing team, despite forecasting a higher average revenue per user (ARPU), fails to achieve the desired balance between acquisition costs and long-term customer value. The resulting CAC: LTV ratio exceeds industry benchmarks, suggesting a miscalculation in the marketing strategy.

Industry Benchmarks CAC:LTV in Marketing and More Considerations:

Various sources, including Toptal, recommend a target CAC: LTV ratio of 3:1. In this scenario, the actual performance falls short, emphasizing the importance of aligning acquisition costs with historical data and industry benchmarks. The example, while simplistic, highlights the dangers of setting aggressive customer acquisition costs without grounding them in reality.

The DTC Marketing Group Approach:

At DTC Marketing Group, we’re not just about growing consumer brands; we’re about doing it profitably. Our consultancy brings a unique perspective, shifting the focus from advertising expenses to investments. We understand that growing a brand isn’t as complicated as growing it profitably. By combining the rigor of an investment banker with marketing expertise, we help brands revolutionize their advertising strategies, ensuring they invest wisely rather than spend mindlessly.

As we navigate the detour between revenue and profitability, the analysis of the real-life scenario underscores the importance of realistic expectations and data-driven decision-making. Aligning customer acquisition costs with historical data and industry benchmarks is not just a best practice but a necessity for achieving profitable growth. DTC Marketing Group stands at the forefront of this mission, guiding brands toward making informed and strategic marketing investments for sustainable success in the DTC realm.